I Feel An App-O-Rama Coming On

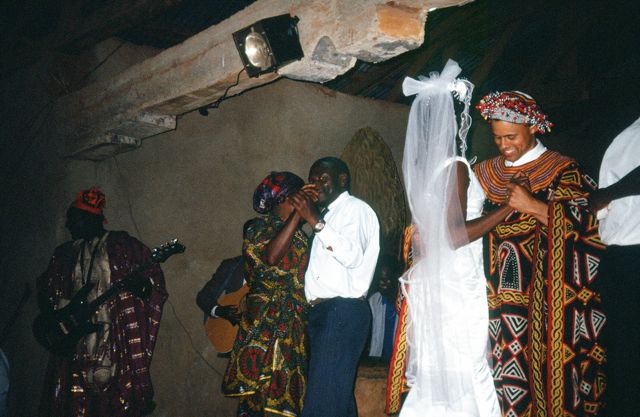

One of my brothers was in the Peace Corps after college. He spent two and a half years in a small village in Cameroon, and that is where he met his wife, who happens to be a princess in the village. (Yes, really). The two of them got married after my brother finished his Peace Corps service, and then they moved to the States, where they started a family. Now that their twins are four years old, they have decided to move back to Cameroon. And we’d like to visit them next summer. Which is why I feel an App-O-Rama coming on.

If you are new to this and don’t know what that means: an App-O-Rama is when you apply for multiple rewards credit cards on the same day in order to get the bonuses from each card. Many people in the Points and Miles community are on a 3-4 month App-O-Rama cycle, applying for a handful of cards each time. While Josh and I are relatively conservative, we definitely scoop up a fresh batch of cards every few months. Of course, if you’ve got a big loan coming up (mortgage, car, student), you should probably not apply for new credit cards. Similarly, you should back away slowly if you won’t be able to pay off your balances in full each month. Since neither of those caveats apply to us, we indulge responsibly. 🙂

I love my Points and Miles collecting hobby because it provides my family with the ability to travel to places that we normally could never afford. This trip to Africa is a case in point. Tickets from California to Cameroon are around $2,000 each. Eight thousand dollars for just one part of a family vacation is just not in our budget. However, with the gigantic credit card sign-up bonuses available these days, a vacation to Africa (and Europe, what the heck, why not!) is no problem. In fact, I’m going for First Class on this trip. So I need to start raking in those miles!

At the top of my wish list is (no surprise) the Club Carlson Visa. I am seriously loving Club Carlson these days, and this card just makes me love them even more. At first glance, these Club Carlson credit cards seem pretty basic. However, the awesome part about these cards is that they all feature a “bonus reward night.” This is huge, because it is a benefit that can effectively double your points; if you redeem points for a 2-night stay, your second night is free. So if you are traveling as a family and both adults have a Club Carlson card, you could stay 2 nights under one reservation, then swap to the second reservation and stay 2 nights, and so on. Here is a rundown of the different perks you get with each card:

Club Carlson Premier Rewards Visa Signature

- 5 Club Carlson points per dollar on daily spending

- 10 points per dollar on Club Carlson hotel spending

- 85,000 point sign-up bonus — 50,000 after first purchase and 35,000 more after $2500 spend within 90 days

- “Bonus Award Night” – when you cash in points for an award redemption, your last night is free

- Club Carlson Gold status

- 40,000 points a year on your “card anniversary”

- $75 annual fee

Club Carlson Business Rewards Visa

- 5 Club Carlson points per dollar on daily spending

- 10 points per dollar on Club Carlson hotel spending

- 85,000 point sign-up bonus — 50,000 after first purchase and 35,000 more after $2500 spend within 90 days

- “Bonus Award Night” – when you cash in points for an award redemption, your last night is free

- Club Carlson Gold status

- 40,000 points a year on your “card anniversary”

- $60 annual fee

I am seriously considering applying for a double shot of these cards, that is: both of them. The combined total of 175,000 points (after making the minimum spend) would be worth over $3,000 towards our hotel stays in Europe (rooms at some of the Club Carlson properties in Europe go for $500/night, and with the bonus night feature, 150,000 points would equal 6 nights if we play our cards right).

Another reason that I would apply for both of these cards on the same day is that it’s likely that the two inquiries would merge into one on my credit report. This would mean that my score would only get dinged from one inquiry instead of two.

I’m also planning on a US Airways card. The current best offer for this card is 35,000 miles with the $89 annual fee waived for the first year. The reason I’m interested in this card is that it won’t be around much longer, and those US Airways miles will get tossed in with my American miles when the two airlines merge. I want to build up my American balance in anticipation of our trip to Europe/Africa, so this would be a good way to do that.

The last card I’m considering is a Virgin America Visa. The current bonus on this card is 20,000 points. I’ve already got one of these cards, but reportedly they are churnable (you can apply for – and get – the same card/bonus more than once). Virgin America has some interesting transfer partners that I might be able to leverage on a future trip, so this card might be good to throw into the mix. I’ll see how I’m feeling on the day of my App-O-Rama.

A big reason I chose these four cards is that I know the issuing banks will either pull my credit report from Transunion or Equifax. This is key for me, because Chase and Amex have hammered my Experian report over the past year, so my score is significantly lower (770) than my Transunion (808) or Equifax (796) scores. Also, with Transunion or Equifax, if I ever wanted/needed to do so, I could “bump” these inquiries off (see this post for details). Currently, my credit scores are high, so this isn’t a big concern, but I’d like to leave it open as an option.

So there you have it. I’m still considering if this is the right mix of cards, but I think I’m going to pull the trigger soon!

What about you – have you done an App-O-Rama lately? How’d it go for you?

- If you enjoyed this post, consider joining the Points and Pixie Dust community and sign up to get emails each day (1 per day)!

Haven’t tried this but the 40,000 mile US Airways is still available:

http://boardingarea.com/blogs/viewfromthewing/2013/02/18/us-airways-mastercard-signup-bonus-changes-for-the-worse-but-how-you-can-still-benefit/

@Clint, thanks for the tip!

hi.. i see you mentioned you have learned how to get hard inquiries off your cr.. could you please help and explain.. thank you

@Joclijoma – yes! I recently wrote a 3-part series on this topic. You can read the first post in the series here: http://pointsandpixiedust.boardingarea.com/?p=1589

When the AA/USA merger takes place, IF CITI get the new American credit card, what will happen to the Barclay USAirways MasterCard. I have two open right now . . . Will it be cancelled if CITI gets card and will that damage credit by having cards CANCELLED.

I was thinking about transferring my account to a no annual fee Barclay, if that is possible!?

Would that be a good idea at this time to start moving to the no fee?

Have never had a CITI AA card . . . Should I get one to start building miles for the new alliance, but what will happen to that card too if cancelled? don’t want to hurt my score with cancelled credit cards! Thanks!

Hi BFD – If Citi gets the cards, holders of Barclay’s cards will be notified that their accounts will close, but will likely be offered a competing reward card. In addition, members of US Airway’s Dividend Miles frequent flier program will become members of the American AAdvantage program, and all the miles in both accounts will merge.

I’m not sure if you can transfer your account to a no fee card – probably best to call Barclay’s and ask.

In terms of getting a Citi AA card, if the Barclay’s cards are closed, the Citi cards will stick around. I would assume that this is the most likely scenario, but since I can’t see the future I don’t know for sure.

Good luck with your App-O-Rama!

You’re not the only one who feels an App-O-Rama coming on 🙂 I’ve never done one, but I’m expecting a big windfall of money in the next few months, all of which I’m going to spend again paying off old bills and replacing old and broken things around the house. I figure if I’m going to drop $20,000 in three months anyway, the least I can do is get some miles out of it. I’ve been reading like a maniac, trying to figure out the best way to pull this off, and blogs like yours have been SO helpful. Thanks, and I hope your App-O-Rama (and trip!) go great!

@Erin – woo-hoo! Write back and let me know what cards you decide to get. I always love to hear what people decide to include in their App-O-Ramas!

Thanks I am also about to do my own as well! Miles & Points! Miles & Points!

Chanel – Sounds like you are just as enthusiastic as I am! Can’t wait to hear how your AOR goes.