Chase Sapphire vs. Chase Sapphire Preferred

Since the $95 annual fee on my Chase Sapphire Preferred card is due next month, I decided to call Chase yesterday to find out if they would waive the charge. The answer was no, but it got me thinking about what the card is worth to me. I quickly realized that $95 was a small price to pay for all of the points, miles and other benefits I enjoy from this account. I also realized that since there are two versions of the Sapphire card, it might be worth it to compare the two.

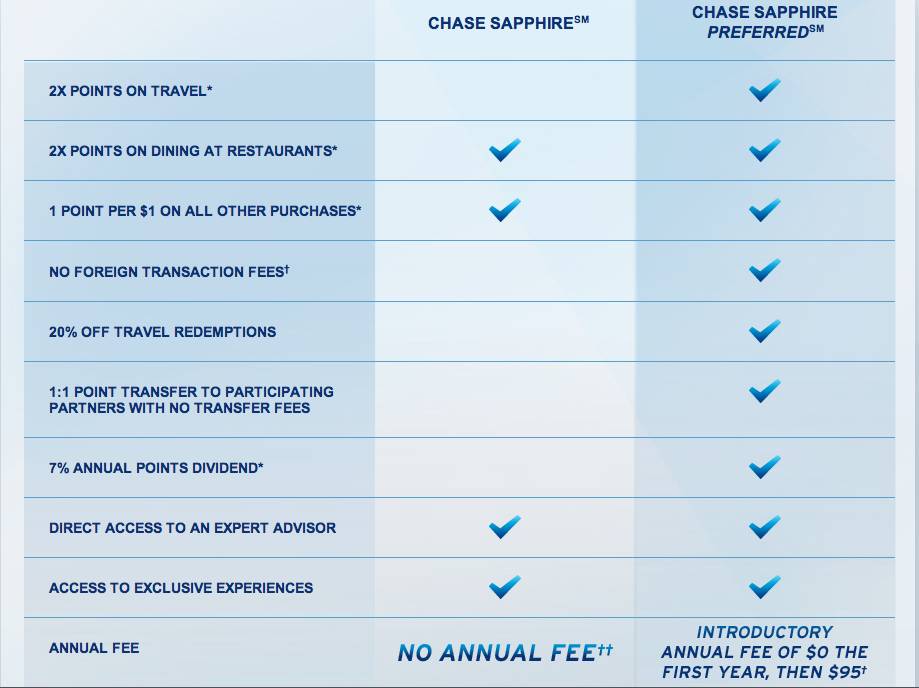

Here is a quick snapshot of each card:

As you can see, the Preferred version is clearly superior if you are in it for the points, miles and travel:

- With the regular version, you cannot transfer your Ultimate Reward points to loyalty partners. Ack!!

- You will not get a 25% bonus when using your points as as the “pay for travel” option with the regular card.

- The regular version of the card has foreign transaction fees of 3%

- You do not get a 7% points rebate each year with the regular version

When I called to ask for a retention bonus, one of the options the rep gave me was to downgrade my Sapphire Preferred to a Sapphire. I refused for all of the above reasons, plus one more: if you downgrade to the regular from the Preferred, you cannot re-apply for the regular card and receive the sign up bonus (currently 10,000 points, but was previously 25,000 points). So, if the regular version appeals to you, factor that into your consideration.

It is also important to note that while both cards earn points per dollar, the points cannot be used the same way! Chase Sapphire points can only be used for fixed-value travel, merchandise redemptions, and statement credits, while Sapphire preferred points can be used in all of those ways, plus they can be transferred to loyalty partners. Loyalty partners include United (great redemption value here, with only 12,500 points needed for a SuperSaver one-way domestic fare), Southwest (another gem because of Wanna Get Away fares), British Airways (can provide great value with short-haul flights), Korean Air (partners with Delta), Hyatt (use 22,000 points for award nights at luxury properties), Priority Club, Marriott, Ritz-Carlton, and Amtrak.

As I’ve stated before, I’m very happy with my Chase Sapphire Preferred card. It’s actually in my wallet (vs. in my overflow hiding place), and I use it frequently. The Chase Sapphire Preferred card was the very first card I got as a points and miles collector, and it has a special place in my heart for that reason as well. It’s a keeper!

I just \found your blog (thanks to your million miles interview) and I like your theme,living luxe for less’- I was just wondering this very same thing….do they waive the fee for sapphire preferred? I guess not,so I have to decide if it’as worth keeping…. is there any other card that still provides access to ultimate rewards if I cancel this card? I like that perk…but for now SWA has my loyalty ….I know I can use the card and transfer in, but is it worth paying 2 annual fees?

@JM – the Chase Ink Plus and Chase Ink Bold cards also provide access to Ultimate Rewards. Current bonus on these cards is 50,000 UR points. They are business cards. Daraius has a good post on how to qualify as a small biz owner – read this for details http://millionmilesecrets.com/2011/06/09/3-ways-you-may-qualify-for-a-business-credit-card/

hi! i found your blog helpful. i am also debating whether or not to keep my preferred card. do you know if chase freedom provides access to ultimate rewards? thanks!

Queenohipop – Glad you like the blog! Chase Freedom provides access to Ultimate Rewards in tandem with the Sapphire (so you need to keep both if you want to earn/use Ultimate Rewards). Hope that helps!