How to earn thousands of free points with the Barclaycard Arrival.

The Barclaycard Arrival is quickly becoming one of my favorite rewards cards. I love that I can use Arrival rewards for any kind of travel – for example, boutique hotels, or flights that weren’t available with miles. This flexibility makes it easy to create the exact types of trips that I want to take….and ensures that these trips are (almost) free.

How? By combining award stays (using hotel points) and flights (using airline miles) with the ability of this card to pay for additional travel costs such as rental cars or train tickets, our out-of-pocket spend has been reduced by hundreds.

And that’s always a good thing.

If you don’t already have the card, here’s the scoop:

- The sign-up bonus is great. The 40,000 bonus miles are worth even more, when you consider the next bullet point…

- Each time you redeem points for travel, you get 10% of those miles back (i.e. redeem 40,000 miles for travel and get 4,000 miles back)

- The card is super easy to use (when you use the card, you get 2x miles, which you can spend on travel…any travel!). You don’t have to think much about where to use the card OR how to redeem your miles. It’s just easy.

So that’s awesome.

How to earn even more miles for free!

Barclaycard has layered on additional perks lately that make me even happier that I have the card. One of these perks is the Barclaycard Travel Community. When you join the community, you can earn free miles simply for creating an online profile and posting stories about recent trips you have taken. The miles are deposited directly to your Barclay Arrival account.

It took me about five minutes to earn 700 points (500 for creating a profile and 200 for a story with a photo).

Earn miles even if you aren’t a cardmember

If you don’t have a Barclay Arrival World Mastercard yet, you can still earn miles.

If you are not a cardmember, once you reach 2500 miles, an Amazon e-certificate will be automatically emailed to you. (Tip: you probably do not want the Amazon certificate, as it is only worth $5).

Or, you can bank miles now (up to 2400, I assume) in anticipation/preparation for getting the card.

If you are a cardmember, once you link your Barclaycard Arrival account to your Travel Community profile, any miles you earn will be transferred to your Barclaycard Arrival account each month. You’ll see they are referenced as Participation Miles on your statements.

Another way to earn more miles

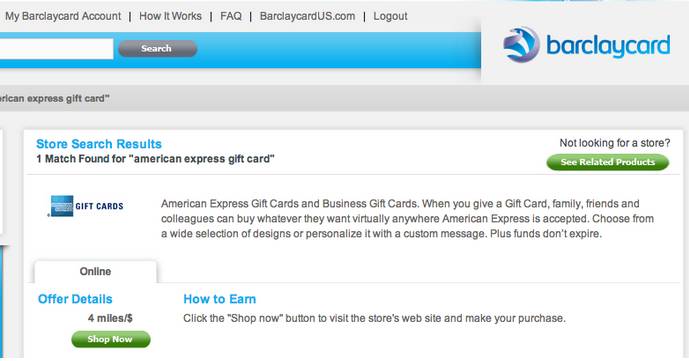

If you already have a Barclaycard Arrival, you can earn more miles by going through the Rewardsboost shopping portal. Once you are logged in to your account, this shows up on the home screen.

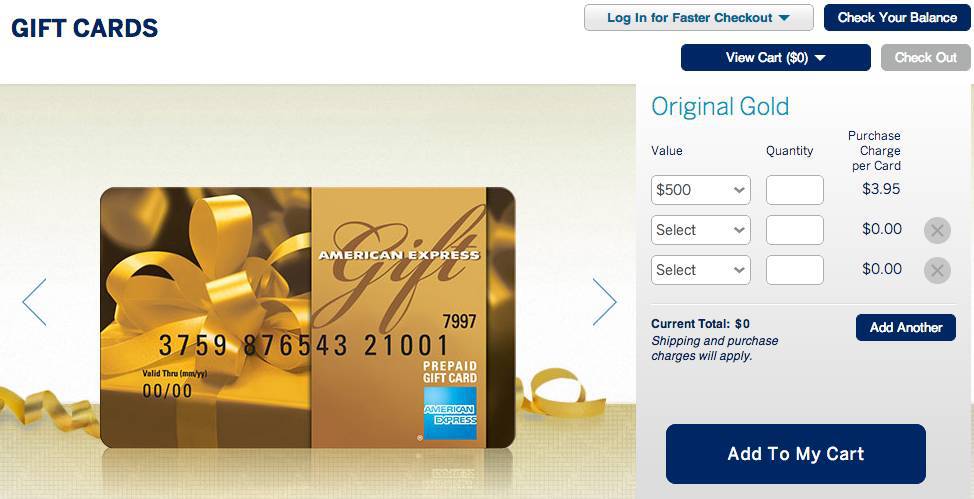

Currently, the Rewardsboost portal is offering 4 miles per dollar when you buy American Express gift cards. This is in addition to the 2 miles per dollar that you already get from using the card, so your total miles payout is actually 6 miles per dollar. Since you get a 10% rebate when you use your miles, this translates to 6.6% cash back towards travel!

Normally, there is a $3.95 purchase charge per card. However, you can currently use the code FPVALAF to waive this charge. (Note that shipping charge of $8.95 per order is not waived.)

You can purchase a maximum $5,000 per order.

Personally, I’m so glad that this card hit the scene! It’s really become a useful tool in my Points and Miles Toolkit.

Do you have the Arrival card yet? What do you think?

.

I am a Barclay’s Arrival cardholder and loved the 40,000 mile bonus as well as the free FICO score the card provides. However, I plan on cancelling the card when my annual fee. Why, it has an annual fee of $89. The Capital One Venture Card has an annual fee of $59. While it is true, you earn 0.2% more per dollar back with the Arrival card, one would have to charge $15,000 a year to overcome the $30 higher annual fee of the Arrival card compared to the Venture card.

I like most Boardingarea.com readers am constantly applying for new credit cards, almost all of which have minimum spend requirements to meet the “bonus” requirement. Combine that with periodic bonus offers from various credit cards I have, and I’m not sure I would be able to put $15K a year more on a Arrival card vs a Venture card to make it worthwhile.

Spectacularly bad math here: why are you counting the $15K additional charge required on the Arrival card earning revenue only at 0.2%, to get to the $30 difference between the two cards’ annual fees? The Barclays arrival would always to earn at 2.2%. The number you are looking for is not $15000 (sheesh), it is $1095. You would have to spend $1095 additionally a year just to cover the higher annual fee of the Barclays arrival card. And here is how you get to it:

– The Capital One Venture card requires an annual spending of $2950 to cover just the $59 annual fee, with that $2950 earning 2%.

– The Barclays Arrival card requires an annual spending of $4045 to cover the $89 annual fee, since it has a return of 2.2%.

The difference is $1095.

Arlington Traveler – I am looking forward to reports of retention bonus offers with this card! If they will waive the fee next year, it definitely is a keeper 😉

We (my wife) just got the Arrival card on our latest churn. I think that cash back cards are going to be more and more useful as time goes on

With the Amex GC’s, are you able to load these cards into Bluebird? Can you add a pin to those GC’s?

Hmmm. Love the idea of the AmEx gift cards bought thru the Barclay portal to earn 4x bonus points. Would REALLY love to buy the AmEx card with my Barclay card for 2x points, however; this morning when I purchased an AmEx e-gift card ($100 test run – no fees & obviously no shipping cost), the only method of payment allowed/option was AmEx card. Couldn’t use my Barclay 🙁 Do the physical gift cards have different payment options? Was all set to start buying the max AmEx e-gift cards ($250 every 7 days) and then go thru Barclay Portal again to spend them at Lowes (3x bonus) for our remodel. That would yield 9x my actual spend (I realize 7x spend isn’t shabby – but, ya know! Curious to know if I will get AmEx membership reward points for my purchase of e-gift card using AmEx card.

@Paul G:

Short answer, NO. No pin so can’t load on BB.

No – the AMEX GCs can’t be used for loading BB directly or given a PIN. You recycle this plastic 1k at a time at your local Bezos recycling center or use it to buy beans at your local beanery.

Always appreciate these posts, both the oppty and explanations.

Points with a Crew – I think you might be right.

Paul G – No, you cannot load these onto your Bluebird card. I wish!

AllAmericanAmy – I think the 6x points Barclay deal is only good for physical gift cards. If you used your Amex card to purchase the e-gift card, then yes – you will definitely get Amex points for that (as long as the card is a points-earning card!)

Marshall and Aloha – Thanks for helping out!

Rebecca – 🙂